Why You Should Manage Winners

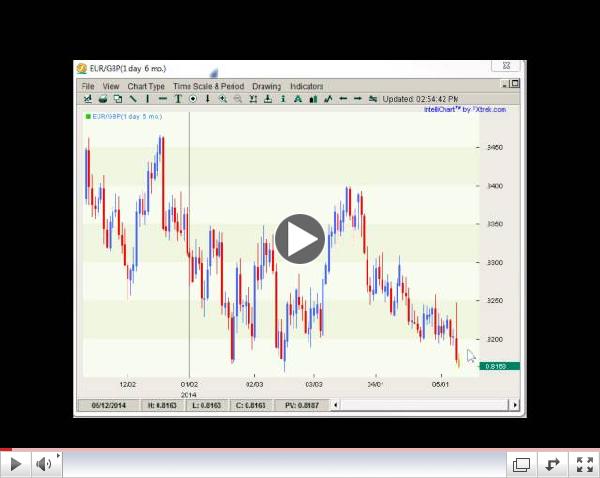

A few weeks ago I made an offhand comment in one of my columns that managing losers is useless and that as traders we should only focus on managing winners. This elicited wails of protest from some of my readers who wanted to know how I could possibly make such a heretical claim! So let me explain exactly what I mean. Every trade we make is either a win or a loss. That sounds ridiculously obvious but I don't think any of us psychologically accept that fact. Most of us place a trade and assume that it is going to be a win. After all, why trade, if you aren't going to win? I think most us have a very hard time accepting the reality of risk. As the great Mike Tyson once said,"Everybody has a plan until they get punched in the face." So instead of accepting our losses what do we do? We do everything in our power to make them go away. We average in. We add money to the account in order to avoid a margin call. We leave the trade on the books and turn a day scalp into multi month investment. Most of the time these tactics fail miserably and we pretty much lose all our money.The few times they work they simply build the foundation for a much larger loss down the road. So the simple rule for managing your losses is -- don't. It you trade small and you trade often each loss should be miniscule relative to your account size. I generally keep my losses to 20 basis points of equity and never more than 100 basis points. I am always astounded at how such a simple change in my behavior has resulted in much better performance in my trading. You can make a lot of money if you don't lose much. On the other hand winners are a whole different ball game. Someone once told me that almost 80% of all trades are profitable sometime during the lifecycle of the trade. Like all market statistics this one is probably not quite true, as financial prices are notoriously difficult to drop into a standard distribution. ( We don't have 50 foot 5 ton human beings, but we have plenty of trading days that would fit that profile). In any case I think we know from our own day to day experience that many of our positions were profitable sometime during the lifecycle of the trade. That's why aggressively managing winners is vitally important. Say you make a trade with 20 point stop and 20 point target. It goes +19 in your direction and then turns and stops you out. How much did you lose? -20? NO! You lost -39 because that is the amount of points you would need to replace in order to bring your account back to that value. Kathy and I have traded together for a long time now making money in four out of five years. That must be one of the longest retail forex track records out there. Like everyone else we have struggled with trade selection, with market volatility, with bad fills and with a million other problems that befall anyone who trades FX -we have always focused on managing our winners -- and I believe that more than anything else this one tactic has been the key to our success. I know that conventional wisdom tells you to let your winners run. I know that all the backtests show that selling some of your position early and going to breakeven is an inferior strategy than holding on to you ultimate profit target. I know all those things and they are a perfect example of being an academic truth and a lie in reality. How can I be so sure? Well next time you put on a "classic" swing trade with a 500 pip stop and a 1000 pip target and watch the move go +800 in the money and then turn to stop you out -- you tell me who is right.  | | Forex Weekly Techs Where Are The Trades? 05.12-5.16.2014 |

|

Tidak ada komentar:

Posting Komentar