| Thoughts on Trading |

Past Performance Not Indicative... The other day an analyst on CNBC was uber bullish on the US economy basing his argument on the pent up demand in the auto market. "Before the recession, " he proclaimed, " we were running at 17M units per year, we dropped to 10M in '08, and are now at only 15M -- so we have a long way to go, " he stated with utmost certainty.

Really Grandpa? Have you actually talked to the twenty-something's that are to comprise your vast bulge of new buyers? Fact of the matter is that the new generation of consumers couldn't give a flying f* about about cars these days. The romantic notion of a "chariot on wheels" is long gone. Most young consumers these days view cars as strictly pragmatic form of transportation that is more of a nuisance than an item of envy.

In urban areas like New York, many consumers like Kathy opt out for on "on demand" services like Zipcar, and even old dinosaurs like me prefer to lease rather than buy automobiles if for nothing else than the simple reason that I never want to spend as much a dollar on repairs.

My regulator constantly reminds me to say that "past performance is not indicative of future results". While that statement may be at time tiresome, it is nevertheless extremely true when it comes to the markets be they in finance or cars.

That's why when you backtest your strategies you must be constantly aware of the trap of past performance. Sure its nice to have 10 straight years of positive results on the EUR/USD. But what does it really tell you? Trading in euro was vastly different in 2003 than 2013. Moreover the-past-is-the-future fallacy can really hurt you with such pairs as EUR/AUD. This was basically dormant pair for the first half of new century but has now become one of the most active momentum trades in the market.

If you look at results for breakout trades in EUR/AUD for the past 10 years they look horrible, but zero in on the last 10 months and the story changes massively. In markets we get paid for figuring out what will work today and tomorrow, but since we don't know the answer we resort to looking at what worked yesterday -- sometimes that approach can produce valuable insights, but sometimes its absolutely worthless. That why you cannot follow past results blindly and rely on them like a crutch.

When trading the key question to ask is -- are the markets still basically the same today as they were yesterday? And always be on the lookout for the time when the answer to that question becomes -- NO!.

|

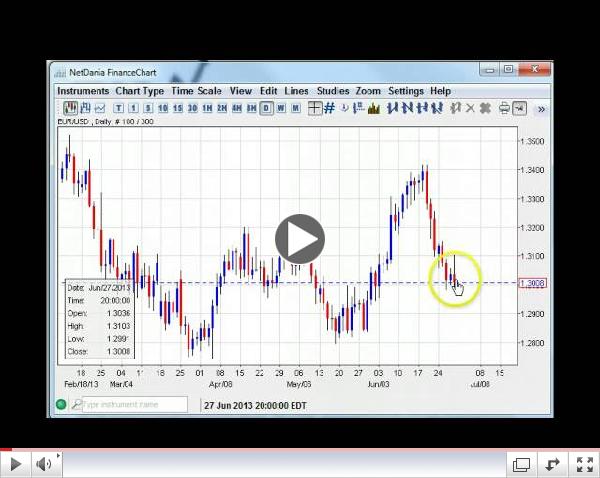

| Forex Technicals Video for the Upcoming Week |

|  | | USD/JPY Retake of 100.00? Weekly Forex Technicals 7.01-06.13 |

|

| Become a Member of BKForex.com

|

2-5 BK Trades Per Week

Each With a Game Plan and

Specific Stop and Exit Directions

Try BKForex.com now for only $59

|

Tidak ada komentar:

Posting Komentar